Fraud is a risk in any business – whether you are a large corporation or a small start-up, potential fraud poses significant risks to your company.

Keep reading to learn what you can do to minimise these risks as much as possible.

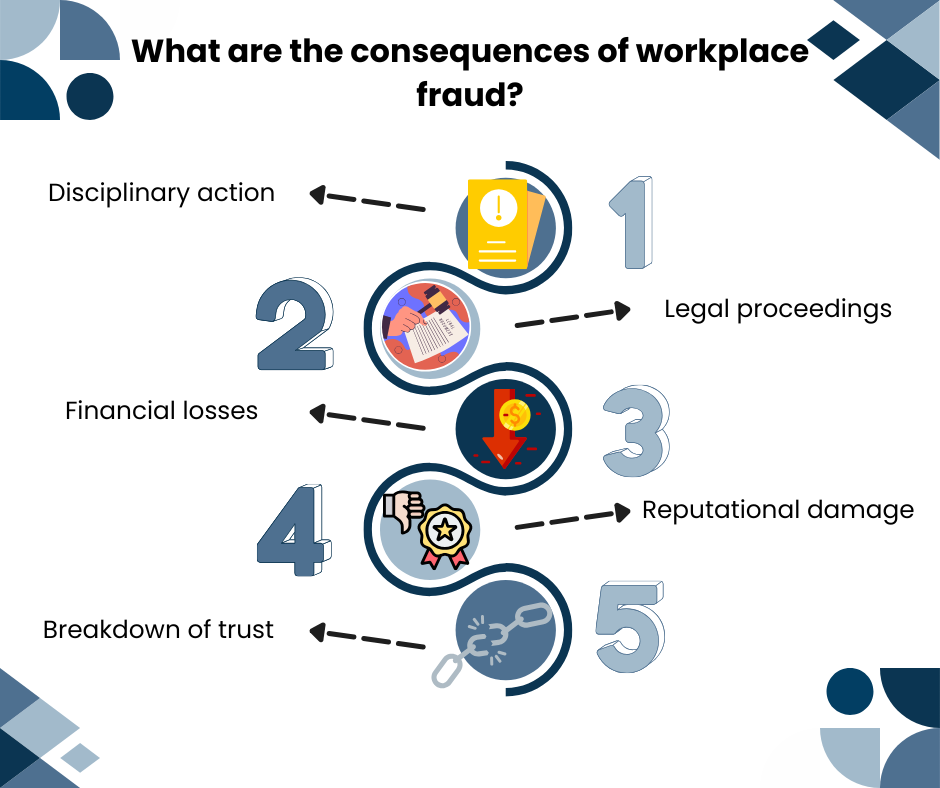

What are the consequences of workplace fraud?

Consequences for workplace fraud can vary depending on severity, they can be levied against an individual or an organisation. They can range from disciplinary action such as a written warning or immediate dismissal for the individual concerned, to legal proceedings for both the individual and the organisation.

Consequences for workplace fraud can vary depending on severity, they can be levied against an individual or an organisation. They can range from disciplinary action such as a written warning or immediate dismissal for the individual concerned, to legal proceedings for both the individual and the organisation.

Organisations may also face financial losses that impact operations, reputational damage and a breakdown of trust between them and clients and between colleagues creating a toxic working environment.

How do you prevent employee fraud?

Employee fraud, also known as internal fraud, is fraud committed by an individual against the company or organisation they are working for.

Employee fraud, also known as internal fraud, is fraud committed by an individual against the company or organisation they are working for.

In order to prevent employee fraud in the workplace, businesses should be implementing a system of controls, where no-one person has overall control of a process or system, and conducting internal audits against these systems to confirm everything is operating as it should.

Watch for unusual transactions, especially high value ones, or transactions being conducted outside of normal working hours. Look for lifestyle changes, people living more lavish lifestyles or spending habits changing.

Question those that resist organisational change or audits, especially around financial procedures, as they may be hiding fraudulent activities.

How do you protect your business from external fraud?

External fraud can be committed electronically through social engineering with fraudsters using techniques such as Phishing, SMiShing, Whaling or Pharming in order to fraudulently obtain money or data.

External fraud can be committed electronically through social engineering with fraudsters using techniques such as Phishing, SMiShing, Whaling or Pharming in order to fraudulently obtain money or data.

Ensuring that employees are trained in the different types of social engineering and how to recognise these methods can assist with preventing external fraud.

Additionally, companies should have robust and tested procedures in place that include ‘vetting’ suppliers and contractors information as well as procedures for questioning unusual requests especially around financial transactions.

How can WA Management help?

WA Management offer a Fraud Prevention online training course designed to educate employees on fraud awareness and how recognise, report and prevent fraud that might be occurring in your organisation.

Fraud Prevention and Phishing Awareness are essential tools in protecting your business from cyber and financial threats. Make sure you don’t miss out on our 10% off deal on these courses, available until the end of September. Simply enter the code ‘info10’ at checkout to save!

Read more Consultant’s blogs here.

To keep up to date with the latest health & safety news and advice, follow us on social media: